Why Meta's Stock Plunge is Actually a Glimpse of the Future

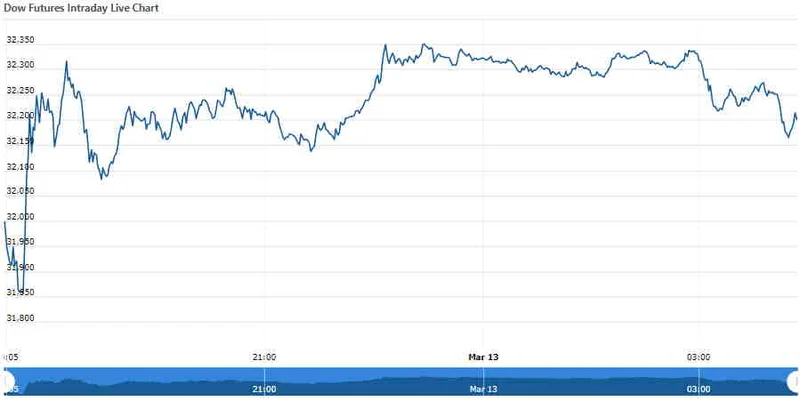

You could almost hear the collective gasp on Wall Street yesterday. The screens were a sea of angry red, with reports confirming that Stocks close lower, with Nasdaq down 1.6% as Big Tech leaders Meta and Microsoft decline after earnings. The headlines, of course, were breathless, pointing the finger at one culprit: Meta. The company’s stock cratered by over 11%, a staggering drop for a tech titan, all because Mark Zuckerberg had the audacity to tell investors he was going to keep spending—massively—on artificial intelligence.

The market’s reaction was immediate and brutal. Analysts tripped over themselves to downgrade the stock, citing "spending concerns" and shrinking operating margins. It was a messy, chaotic day, a maelstrom of earnings reports, Federal Reserve whispers, and a half-baked trade truce with China that left the most important questions unanswered. But as the dust settled, I looked at the carnage not with alarm, but with a profound sense of excitement. When I first saw the numbers, I honestly just sat back in my chair and smiled. Because this isn't the story of a company losing its way. This is the sound of a new world being built, and the price of admission is making Wall Street very, very nervous.

The Cost of Building Cathedrals

Let's be perfectly clear. The market punished Meta for the exact same reason we should be celebrating it. The company’s operating margin dropped to 40%—in simpler terms, their profitability on each dollar of revenue is shrinking because they are pouring unprecedented amounts of capital into building the next generation of AI. Wall Street sees a balance sheet problem; I see the foundation of a new digital civilization being laid.

This is the kind of breakthrough that reminds me why I got into this field in the first place. This isn't about tweaking an algorithm for better ad clicks. This is about fundamental infrastructure. Think of it like the construction of the transcontinental railroad in the 19th century. It was a project of unimaginable scale and expense, funded by speculation, and it was plagued by bankruptcies and financial panics. Investors who only looked at the quarterly profits of a single railroad company in 1870 would have been terrified. They would have missed the point entirely. The point wasn't the profitability of one company; it was that they were laying down the steel tracks that would connect a continent, unleash decades of economic growth, and completely redefine the fabric of society.

That’s what we’re seeing right now. Meta, alongside Microsoft and Alphabet, is laying the tracks for the AI era. This requires building massive data centers, designing new chips, and hiring every brilliant mind they can find—it's an outrageously expensive, high-stakes gamble on a future that hasn't arrived yet. And the market, with its obsessive focus on the next 90 days, simply doesn't have the language to understand that kind of vision. But what if the real risk isn't spending too much, but spending too little? In a race this important, can you truly afford to fall behind?

A Failure of Imagination, Not Technology

The beautiful irony of yesterday’s chaos was the stark contrast between Meta and Alphabet. Google’s parent company soared 5% after reporting rock-solid quarterly results. The market rewarded them for their present-day strength. Meanwhile, it savaged Meta for its future-facing ambition. You see the pattern? The system is designed to reward optimization, not revolution. It celebrates the company that polished the existing machine to a brilliant shine, while punishing the one that's trying to build a completely new one in the garage.

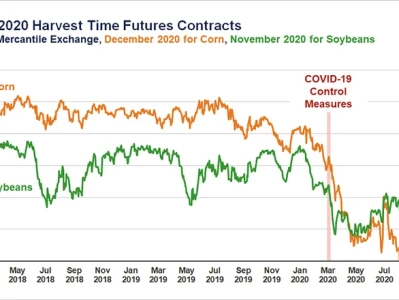

This isn’t a tech problem; it’s a crisis of imagination in our financial markets. We saw the same short-sightedness in the day's other big news. The US-China trade truce was a perfect little package of soybeans and tariffs, but the elephant in the room—the global supply chain for advanced semiconductors, the literal bedrock of the AI revolution—wasn't even meaningfully addressed. This sent Nvidia’s stock down, another shudder of fear from a market that can only process immediate, tangible inputs.

The speed of this is just staggering—it means the gap between the builders who see what’s coming and the traders who only see what’s here is widening faster than we can even comprehend. While an analyst at Mizuho noted "cautious optimism" but worried about Meta's "euphoria over AI spend," I see something else entirely. That "euphoria" isn't a bug; it's the single most important feature. It's the conviction required to build something that has never existed before.

Of course, with this power comes immense responsibility. We must have serious, ongoing conversations about the ethical guardrails for foundational AI. But to let fear of the cost paralyze us at the starting line would be the greatest failure of all. The builders, the engineers, the developers I talk to every day—they get it. They're not spooked. They're electrified. They see the spending not as a liability, but as fuel.

This Isn't a Bubble, It's a Launchpad

Look, I get it. Volatility is scary. Seeing a company lose billions in market value in a single day feels like a crisis. But we are mistaking the tremors of construction for the signs of collapse. What happened to Meta’s stock wasn’t a verdict on the future of AI. It was a referendum on Wall Street’s own inability to price the future. The real story isn't the fear of the investors who sold; it's the quiet conviction of the engineers who are still building. Yesterday wasn't an ending. It was a beginning.