So, it happened. Some analyst somewhere called their shot, predicting Netflix would be the big stock split of 2026, and a few months early, the company obliged. Give the guy a cookie. The internet is flooded with `netflix stock split news`, and everyone seems to be asking the same questions: `when is netflix stock split`? `did netflix stock split`? Yes, it did. Or it will. The `netflix stock split date` is set for November 17th.

But the real question isn't "when," it's "why?" And the answer they're giving us is, frankly, an insult to our intelligence.

The official line, straight from the PR machine (Netflix announces a 10-for-1 stock split), is that this 10-for-1 split is to make the stock "more accessible to employees who participate in the Company's stock option program." Right. Because a company worth nearly half a trillion dollars, a global media empire that has fundamentally reshaped entertainment, is deeply concerned that its own employees can't scrape together the cash to buy a full share at a measly $1,100. Give me a break.

This is a bad reason. No, 'bad' doesn't cover it—this is a paper-thin excuse that nobody with a functioning brain should believe. In a world where every brokerage from Robinhood to Fidelity offers fractional shares, the idea that a high stock price is a barrier to entry is a complete joke. You can buy $5 worth of Netflix right now if you want. This isn't 1985. The whole "accessibility" argument is a ghost, a relic of a bygone era that corporations keep trotting out because they think we're all idiots.

It's a Shell Game, Not a Strategy

Let's call this what it is: pure psychological manipulation. A stock split is the financial equivalent of cutting a pizza into sixteen tiny slices instead of eight normal ones. You don't have more pizza. You just have more, smaller pieces. The total value of the company doesn't change by a single cent. Your personal stake in the company doesn't change. All that changes is the number on the screen, and for some reason, our monkey brains see a smaller number and think "Ooh, bargain!"

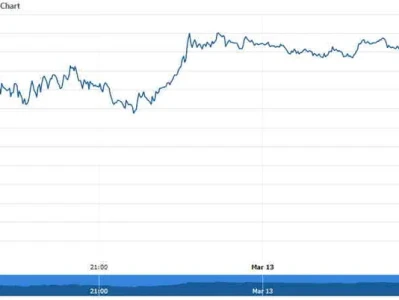

The stock popped 3% in after-hours trading on the news (Netflix stock spikes higher after announcing ten-for-one stock split By Investing.com). Why? Because nothing fundamental changed about Netflix's business. Their revenue didn't magically increase. Their subscriber growth didn't suddenly accelerate. The only thing that happened was an announcement of some basic arithmetic. It’s a confidence trick, a sleight-of-hand maneuver designed to generate headlines and lure in a new wave of retail investors who feel like they missed the boat when the stock was in the four-figures.

And it always works. It’s like a magic trick you’ve seen a dozen times, you know exactly how it’s done, but you still clap at the end. The company gets a little sugar rush of positive sentiment, the stock gets a temporary liquidity boost, and the news cycle moves on. It's a cheap, easy way to juice the stock without actually, you know, improving the business. I just can't shake the feeling that it's a distraction. Remember that recent earnings dip? The one they blamed on a $619 million tax bill from Brazil? Everyone just sort of shrugged it off, but now... a stock split announcement is a fantastic way to change the conversation, isn't it?

The real story at Netflix has nothing to do with this financial engineering. The real story is whether their push into advertising can become the primary revenue driver they're hoping for. It's about whether they can keep hiking prices without seeing a mass exodus of subscribers who are already drowning in a sea of streaming services. It's about fending off Disney, Max, and a dozen other competitors who are all fighting for the same eyeballs and wallets. That's the substance. This stock split? It's fluff. It's the foam on the latte, the sizzle without the steak.

The Illusion of Action

I get why they do it. A CEO's job is to increase shareholder value, and if a simple, cost-free accounting trick can create a perception of value that bumps the stock, then from a certain cynical perspective, it's a job well done. It creates the illusion of action. The board gets to sit around a mahogany table, nod sagely, and approve something that feels important. I can just picture the scene: a sterile conference room, the scent of expensive coffee in the air, as someone in a suit says, "This will democratize ownership," and everyone pretends it's a profound statement and not just a line they read in a memo.

But what does it say about the market when these kinds of moves are rewarded? It tells me that we're not rewarding innovation or solid fundamentals as much as we're rewarding clever marketing. We're a bunch of Pavlovian dogs, salivating every time a company rings the stock-split bell.

And the analysts, offcourse, are eating it up. Wedbush is slapping a $1,400 price target on the stock, talking about "substantial growth in global advertising." They're not wrong about the potential, but it feels like the split is being used as a booster rocket for that narrative. They're bundling the meaningless news with the meaningful analysis to create a more potent cocktail of hype. It’s a classic Wall Street move. Don't just sell the steak, sell the sizzle, the plate, the waiter's tuxedo, and the fancy lighting overhead. Sell the whole damn experience.

Then again, maybe I'm the one who's out of touch. Maybe this is just how the game is played now. The fundamentals are just a small peice of the puzzle, and the rest is narrative, perception, and meme-stock energy. Maybe the answer to "when will Netflix stock split?" was always "whenever they needed a good headline."

So, Who's Getting Fooled Here?

At the end of the day, a 10-for-1 stock split changes absolutely nothing about Netflix as a company. It's a cosmetic procedure, a fresh coat of paint on a house whose foundation is what really matters. If you believed in the company at $1,089 a share, you should believe in it at $109. If you thought it was overvalued before, you should think it's overvalued now. The math is the same. Don't let the corporate spin artists convince you that changing a ten-dollar bill for ten ones has made you any richer. It hasn't. And if you think it has, then you're the one they were counting on all along.