The Soybean Paradox: Why a 13-Month High is a Market Head-Fake

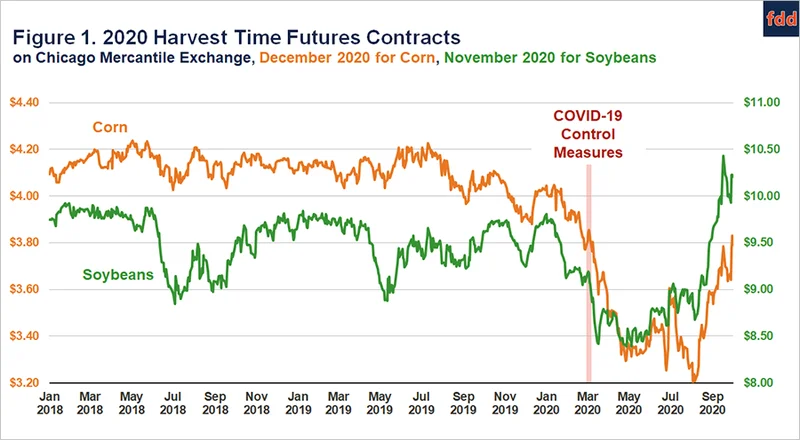

The market is telling a story of optimism. Soybean futures recently surged above $11 a bushel, hitting a 13-month high on whispers of a U.S.-China trade deal. The November contract jumped a good 45 cents in a hurry, pulling corn and wheat up in its wake. On the surface, it looks like a recovery—a long-awaited reprieve for farmers who have been squeezed for years.

But headlines are not fundamentals. As an analyst, I’ve learned that the most dangerous market narratives are the ones that feel good but ignore the underlying data. This rally is a classic example. It’s a sentiment-driven spike built on the hope of a political resolution, and it’s distracting from a much larger, more troubling mathematical reality: the world is still swimming in grain. While farmers in Minnesota and across the Midwest are understandably desperate for a win, this price surge looks less like a turning point and more like a bull trap.

What happens when a market’s emotional state becomes completely decoupled from its physical supply and demand? And more importantly, who gets hurt when gravity inevitably reasserts itself?

Deconstructing the Structural Glut

Let’s set aside the trade talk chatter for a moment and look at the numbers that actually govern long-term profitability. Rabobank, in a recent and sober analysis, projects that U.S. corn and soybean farmers likely won't see a return to a "breakeven" environment until the 2027-28 crop year. That’s not a typo. We are looking at potentially two to three more years of depressed prices and weak margins.

The reason is simple and brutal: oversupply. Years of massive harvests, not just in the U.S. but also in South America, have created what one analyst called "monster supplies." Corn production is expected to top 16 billion bushels for the first time ever, and even with record exports, stockpiles are projected to swell to a seven-year high. This is the core of the problem. You can’t fix a global supply glut with a single purchasing agreement, no matter how large.

This is the part of the analysis that I find genuinely puzzling. The disconnect between the futures market, which is reacting to a potential demand-side catalyst (the China deal), and the physical reality of overflowing silos is one of the starkest I've seen in a commodity cycle. It’s like watching the stock price of a company with declining revenue and bloated inventory soar because of a rumor about a new CEO. The rumor might be exciting, but it doesn’t change the balance sheet.

The input costs add another layer of pressure. While they've fallen from their 2022-23 peaks, Rabobank notes they have been "very, very sticky." Farmers are still paying historically high prices for fertilizer and other inputs while the price they receive for their product remains weak. This margin compression is the silent killer of farm profitability.

To bring the global balance sheet back into alignment, Rabobank estimates the U.S. needs to take a significant amount of land out of production. Principal crop acres have already dropped by about 7 to 8 million acres—to be more exact, the analysis suggests we likely need to lose another 3 to 5 million more. Yet the response to the current market signal might do the opposite. A potential China deal that favors soybeans could simply encourage farmers to shift acres from corn to soy next spring. That doesn't reduce the total supply; it just rearranges it. With 2025 corn plantings already at 98.7 million acres (the highest level since 1936), we are starting from a position of maximum output.

A Rally Built on Sand

So what is this $11 soybean price, really? It’s a speculative premium based on an uncertain outcome. The market has priced in a best-case scenario: a swift trade deal that includes massive, sustained Chinese purchases of U.S. agricultural products. Market analyst Angie Setzer correctly noted that for prices to move even higher, the market needs "a confirmation of size and intent" of what China will actually buy.

That confirmation is the critical missing variable. Without it, the rally is built on sand.

This creates a dangerous calculation for the individual farmer. The frustration that drove them to feel the impact of the trade war is now being replaced by a tempting, but likely fleeting, sense of hope. An analyst in the report wisely cautioned farmers that this is a good time to get some sales on the books. This is the cold, rational advice. Selling into a sentiment-driven rally to lock in a price that is temporarily detached from fundamentals is a sound risk-management strategy.

The alternative is to hold on, betting that the political outcome will be so overwhelmingly positive that it can single-handedly absorb a global surplus. That is a low-probability wager against a mountain of bearish supply data. It’s a bet on a headline, not on the harvest.

The market is an auction of expectations. Right now, expectations for a political fix are running high, creating a price that the physical supply data simply does not support. The question is not if the price will eventually have to reconcile with the fundamentals, but when. For the farmers making planting and selling decisions right now, that is a billion-dollar question.

The Math Simply Doesn't Support the Narrative

Let's be perfectly clear. The recent optimism in the soybean market is an emotional response, not a data-driven one. While the hope for normalized trade relations is understandable, it cannot defy the fundamental laws of supply and demand indefinitely. The world has too much grain, and input costs are too high. The Rabobank forecast for a return to breakeven in 2027 or 2028 isn't a pessimistic opinion; it's a mathematical conclusion based on global inventory levels. This rally is a selling opportunity, not a sign of a sustainable recovery. Betting on anything else is betting against the numbers.