Qualcomm's AI Pivot: Hype or Hypergrowth? Here's the Data.

Alright, let's dive into Qualcomm (QCOM). The narrative is shifting. It's no longer just a mobile chip company; it's an "AI innovator." That's the buzz, anyway. But does the data support the hype? Let's dissect it.

The AI Rebrand: Inference is the Name of the Game

Qualcomm's unveiling of the AI200 and AI250 accelerator systems is the catalyst for this rebrand. The claim? Direct competition with Nvidia (NVDA), AMD, and Broadcom (AVGO) for AI inference workloads. A bold move, considering Nvidia’s current dominance.

The key here is inference versus training. Qualcomm is betting that the future of AI lies not in building the models (training), but in deploying them (inference) on billions of devices. Makes sense, given their expertise in low-power, high-efficiency design. They are targeting a market where their existing edge computing strengths give them a theoretical advantage.

The AI200 (shipping in 2026) and AI250 (2027) support up to 768 GB of memory per card. The claim is a tenfold increase in bandwidth and reduced energy consumption thanks to "near-memory computing architectures." Sounds impressive, but we need independent benchmarks to verify those claims. How does this translate to actual performance gains in real-world applications compared to existing solutions?

Humain AI (backed by Saudi Arabia) is cited as an early adopter committing to "large-scale deployment." That's a win, but one customer doesn't make a trend. We need to see broader adoption across various sectors to validate Qualcomm's strategy. This is the part of the report that I find genuinely puzzling...

By the Numbers: Revenue Mix and Valuation

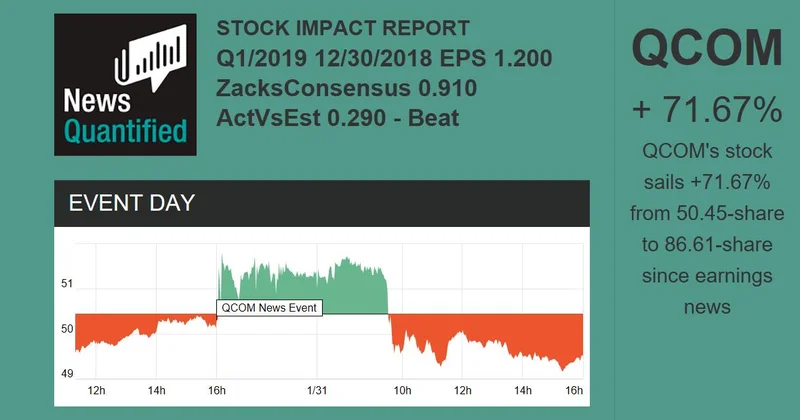

Wall Street expects Qualcomm to deliver roughly $2.86 in non-GAAP EPS on about $10.77 billion in revenue for the upcoming earnings report (due November 5th). This sits near the midpoint of Qualcomm’s guidance range. Solid year-over-year growth is anticipated, but the devil's in the details. The trend to watch is the revenue mix. According to Qualcomm Is Becoming an AI Company. That Means Earnings on November 5 Could Supercharge QCOM Stock., the upcoming earnings report could supercharge QCOM stock.

The IoT and automotive businesses are supposedly approaching a combined contribution that could rival Apple's modem revenue. This is the diversification story to watch. These verticals are tied directly to Qualcomm’s AI-enabled hardware strategy, making them key indicators of progress.

From a valuation perspective, QCOM is trading at about 18x GAAP trailing earnings. That's below the semiconductor sector median of roughly 32x. On a price-to-sales basis, it's at 4.6x versus a 3.6x sector median. And at 7.4x book value compared with 4x for peers. The higher book value multiple reflects the premium investors assign to Qualcomm’s IP portfolio and balance-sheet strength.

But here's the rub: the analyst sentiment is mixed. Among 32 analysts, it's roughly split between bullish and neutral: 15 "buy," and 16 "hold," with an average price target of roughly $182 per share. This suggests a lack of strong conviction in either direction.

Insiders, however, seem to be taking profits. Cristiano R. Amon (CEO) sold 150,000 shares recently for around $24.8 million (to be more exact, $24,833,982 ). CFO Akash J. Palkhiwala has also been a consistent seller. While insider selling isn't always a bearish signal, the scale of these transactions raises eyebrows. Is this simply profit-taking, or do insiders have a less optimistic view of the company's prospects than the marketing materials suggest?

It's also worth noting that Congress members have traded QCOM stock 3 times in the past 6 months, with 1 purchase and 2 sales. The data is too sparse to draw any meaningful conclusions, but it's another piece of the puzzle.

The Thought Leap: Data Gathering and Bias

Before we get too excited, let's consider the source of this data. A lot of it comes from analyst reports and company statements. These sources are inherently biased, as analysts have relationships with the companies they cover, and companies are, well, selling a story. Independent verification is crucial, and that's often lacking.

The "consensus rating" of "Moderate Buy" is a prime example. It's an aggregate of analyst opinions, but it doesn't tell us why those analysts hold those opinions. Are they genuinely bullish on Qualcomm's AI prospects, or are they simply maintaining their ratings to avoid rocking the boat?

So, What's the Real Story?

Qualcomm's AI pivot is a compelling narrative, but the data is not yet conclusive. The company has a solid financial foundation and a clear strategy, but it faces stiff competition and needs to prove that its AI solutions can deliver tangible benefits in real-world deployments. The insider selling and mixed analyst sentiment add a layer of caution. Until we see more evidence of widespread adoption and significant revenue growth from its AI initiatives, it's too early to declare Qualcomm an "AI innovator." It's a company in transition, and the next few quarters will be critical in determining whether it can successfully execute its vision.