Visa and Transcard Turbocharge Freight: Are We Witnessing the Reinvention of Global Trade?

Okay, folks, buckle up, because this isn't just another press release about "embedded finance." What Visa and Transcard are doing with WebCargo by Freightos is quietly revolutionary, a seismic shift that could redefine how global trade happens. Forget the clunky letters of credit and the agonizing wait times. Imagine a world where moving goods across borders is as seamless as booking an Uber. That’s the promise here, and honestly, when I first read about it, I got that familiar tingle of excitement, that feeling that we're on the cusp of something huge.

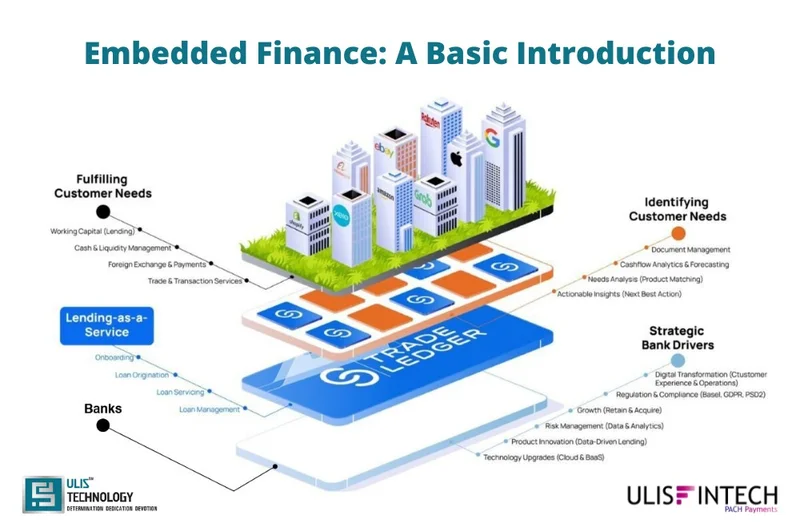

The core idea? Embedding financial services directly into the WebCargo platform. Freight forwarders and airlines can now access flexible credit, onboard instantly, and automate reconciliation—all within the same system they use to book cargo. Think of it like this: remember when you had to go to a bank to get a loan? Now, services like Affirm let you finance purchases directly at the point of sale. This is the same principle, but applied to the incredibly complex world of international freight, using Visa’s virtual card infrastructure and Transcard’s payment smarts. It’s about injecting speed and efficiency into a system that has been, let's be honest, stuck in the slow lane for far too long.

The "Aha!" Moment: Frictionless Trade

What’s the "Big Idea" here? It's frictionless trade. For years, the friction in global commerce—the paperwork, the delays, the sheer complexity of payments—has acted as a drag on economic growth. This partnership is about removing that drag, about making it easier for businesses of all sizes to participate in the global marketplace. As Freightos CEO Zvi Schreiber put it, they're moving "one step closer to a future where international trade is as easy to transact as booking a flight or taxi online.” And frankly, that's a future I'm incredibly excited about. According to a recent article, Visa and Transcard Power Embedded Finance for Freight Industry, this collaboration aims to streamline financial processes within the freight industry.

Visa and Transcard aren’t stopping there, though. They’re also exploring how to use AI in the B2B space, which, if you ask me, is where things get really interesting. Imagine an AI assistant that automatically optimizes payment terms, manages risk, and ensures compliance with international regulations. It sounds like science fiction, I know, but the building blocks are already in place.

Of course, with great power comes great responsibility. As we automate more of the financial system, we need to be mindful of the ethical implications. Who is responsible when an AI makes a bad decision? How do we ensure that these systems are fair and transparent? These are questions we need to be asking now, before these technologies become too deeply embedded in our lives.

But let’s not get bogged down in the potential pitfalls. The potential upside here is just too enormous to ignore. If we can truly create a frictionless global trading system, we can unlock a new era of economic growth and opportunity. We can connect businesses and consumers in ways that were previously impossible. We can create a more prosperous and interconnected world for everyone.

The Dawn of Hyper-Connectivity

This partnership is more than just an upgrade to existing systems; it's a glimpse into a future where technology dissolves the barriers to global commerce. It's about empowering businesses, fostering innovation, and building a more connected world. And that, my friends, is something worth getting excited about.