Generated Title: No, the IRS Isn't Giving Away Free Money (Again)

The internet's buzzing about another round of stimulus checks, supposedly hitting bank accounts this November. Amounts like $1,390, $1,702, even a cool $2,000 are being thrown around. Before you start planning that vacation, let's inject some data-driven reality into this digital frenzy.

The Usual Suspects: Scams and Misinformation

First off, the IRS has explicitly stated: no new stimulus payments are authorized. That's about as clear-cut as it gets. These rumors tend to surface during times of economic uncertainty, and this year's government shutdown is prime breeding ground for misinformation. People are anxious, and anxiety makes them click on dodgy links promising "guaranteed payments."

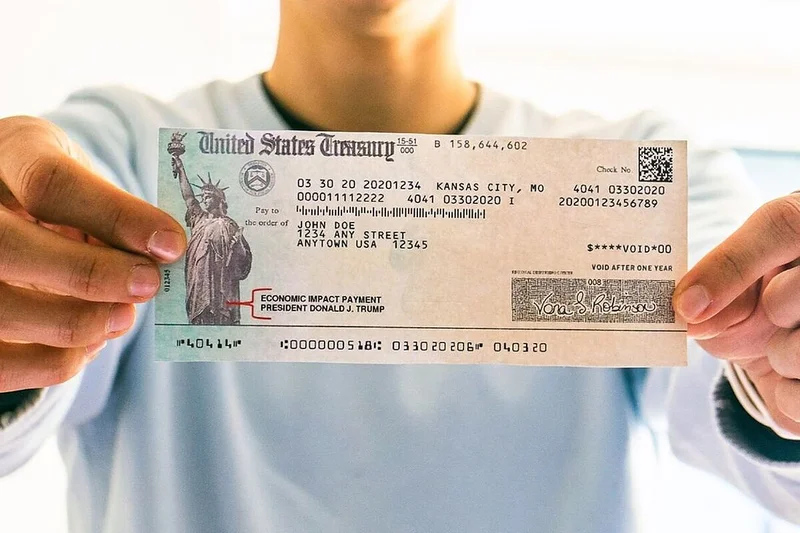

It's the same playbook we've seen before. Scammers dangle the carrot of free money to phish for your personal and banking information. They might misuse terms like "stimulus check" – the IRS officially called them "economic impact payments" – or pressure you to share your details for "faster" processing. The core principle of digital scamming is to prey on people's vulnerabilities.

The data backs this up. According to the IRS, refund scams are up 40% this year, which correlates almost perfectly with the rise in social media posts about stimulus checks. IRS direct deposit stimulus in October? Here’s what we know

A History Lesson in Stimulus

Let's not forget the actual stimulus payments that did happen. There were three rounds during the pandemic: up to $1,200 per adult initially, then $600, and finally $1,400 in 2021. The deadline to claim the last one, the Recovery Rebate Credit, was April 15, 2025. Any unclaimed funds are now back in the US Treasury's coffers. So, unless Congress pulls a rabbit out of a hat, there's no federal stimulus check coming.

President Trump has alluded to potential "DOGE dividends" – a $5,000 rebate funded by government efficiency savings. He also spoke about using tariff revenue for taxpayer rebates. But let's be blunt: these are just ideas floating in the ether. There's no concrete legislation or implementation plan. It's like saying you're going to build a rocket to Mars; cool idea, but where's the engineering?

State-Level Relief: A Patchwork Quilt

While the feds aren't handing out stimulus checks, some states are offering their own forms of relief. New Jersey has the ANCHOR property tax relief program, offering up to $1,750 for homeowners over 65. Several states, like New York, Pennsylvania, Georgia, and Colorado, sent out "inflation relief checks" to residents who paid higher sales taxes. These are state-level initiatives, not federal stimulus.

And this is the part of the report that I find genuinely puzzling. The variability between States is so extreme – a resident of New Jersey could be getting almost $2000, while someone in another state gets nothing. Is that equitable?

The Tax Refund Mirage

JPMorgan's chief strategist, David Kelly, predicts a surge in tax refunds in 2026, thanks to the One Big Beautiful Bill Act (OBBBA). He estimates the average refund could jump to $3,743, up from $3,186. That sounds great, but there's a catch. Many of the OBBBA's tax cuts are retroactively effective from January 1, 2025, but the IRS isn't adjusting tax withholding rates this year.

What does this mean? You'll likely pay more upfront and get a bigger refund later. Kelly even suggests this could act like "an extra stimulus check," potentially reigniting inflation. But here's my methodological critique: Kelly's analysis assumes consumers will spend their refunds like stimulus checks. And I question that – the data shows that stimulus checks were often used for essentials due to immediate need. Tax refunds, on the other hand, are often used for savings or paying down debt.

So, What's the Real Story?

The truth is simple: there's no free lunch from the IRS. The stimulus check rumors are a mix of wishful thinking, outright scams, and misinterpretations of state-level programs or future tax refund predictions. Stay vigilant, protect your data, and remember: if it sounds too good to be true, it almost certainly is.