So, Waste Management misses earnings by a country mile, whiffs on revenue, and guides down for the year. The stock drops a measly 2.35%.

Let that sink in.

If this were some high-flying tech darling, the stock would be a smoking crater in the ground. We’d see headlines screaming about a "tech wreck" and analysts weeping on CNBC. But because it’s Waste Management—the guys who haul away your pizza boxes and empty bottles of cheap wine—everyone just kind of… shrugs. The `wm stock price today` barely flinched. It’s the ultimate "too big and boring to fail" company, and this earnings report is a masterclass in why that’s both its greatest strength and its most infuriating quality.

Let's be real. The numbers were ugly. Adjusted EPS of $1.49 when Wall Street was dreaming of $2.08? That’s not a miss; that’s a belly flop from the high dive. Revenue came in $260 million short. Yet the whole narrative spun by the company, and largely swallowed by the market, is about "resilience" and "strong operating platforms."

Give me a break.

The Corporate Magic Trick

You have to hand it to CEO Jim Fish and his team. They are masters of distraction. It’s the classic magician’s trick: get the audience to look at the flashy thing in the right hand so they don’t see what the left hand is fumbling.

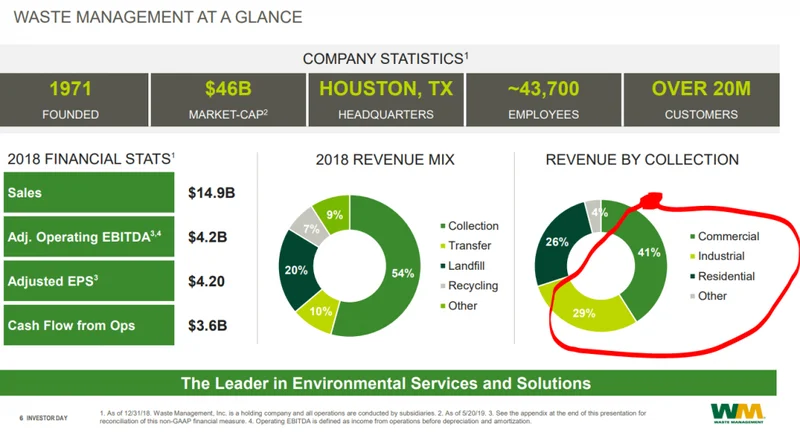

The flashy thing here is the "record-setting margins" in their core Collection and Disposal business. And sure, that sounds great. It means the part of their business that’s basically a government-sanctioned monopoly—picking up trash from people who have no other choice—is squeezing more profit than ever. Congratulations. You’ve perfected the art of charging more for a service people can’t live without. What a stunning achievement.

But what about the left hand? The one they’re hoping you ignore? That’s where things get interesting. The recycling business got hammered, with a $60 million revenue decline thanks to plunging commodity prices. That’s a variable they can’t control, a direct link to the actual, you know, economy. When prices for cardboard and plastic tank, so does that part of their balance sheet. It’s a reminder that not all of WM’s business is a guaranteed paycheck.

And then there's the new toy: WM Healthcare Solutions, built on the back of that massive $7.2 billion acquisition of Stericycle. This was supposed to be the next big growth engine, a brilliant move into the high-margin world of medical waste. The result? "Softer than expected" revenue. The company’s own press release, WM Announces Third Quarter 2025 Earnings, admits to "modestly lower revenue expectations" from the unit. After spending seven billion dollars, "modestly lower" is the kind of phrase that should set off alarm bells. It’s like buying a Ferrari and then complaining that it’s a little sluggish getting out of the driveway.

So what are we really looking at here? A company whose core, monopolistic business is doing great, while its market-sensitive and growth-oriented segments are sputtering. Is this a picture of health, or is it a sign of a company whose foundation is strong but whose ambitions are failing?

That $7.2 Billion Elephant in the Room

Let's talk more about that Stericycle deal. When you spend that kind of money, you're not just buying a business; you're selling a story to investors. The story was about diversification, higher margins, and a "complementary business platform." It was supposed to make the `wm stock quote` look like more than just a utility.

But the ink is barely dry on the deal and they’re already walking back expectations. The company says it’s taking a "disciplined approach to customer engagement" which resulted in "the deferral of some planned price increases."

Let me translate that from corporate-speak into English: "We tried to jack up prices on our new medical clients, and they told us to get lost. So we had to back off."

This is a bad sign. No, "bad" doesn't cover it—this is a five-alarm red flag. It suggests they either overpaid for Stericycle, underestimated the difficulty of integrating it, or both. Big acquisitions are always a mess. I once had to deal with the fallout of my internet provider buying another company, and my bill was wrong for six straight months. Now multiply that headache by a few billion dollars. What are the odds that everything is going smoothly behind the scenes? Are they finding that the synergies they promised on a PowerPoint slide are a little harder to achieve in the real world?

This is where the stability of a company like Waste Management becomes a curse. Because it’s not some volatile meme stock like `bbby stock` was, investors are willing to give it the benefit of the doubt. They see the steady `wm stock dividend` and think everything is fine. But is it? Or are they just funding that dividend by squeezing every last penny out of their garbage collection routes while their big bet on the future slowly deflates?

Don't Look at the Man Behind the Curtain

The most cynical move of all was the guidance. Management "reaffirmed" their full-year guidance for profit and free cash flow. But they trimmed the revenue outlook to the low end of the prior range. This is a classic PR move. You create the headline "WM Reaffirms Guidance" while quietly admitting in the fine print that you’re going to make less money than you thought.

They’re clinging to free cash flow—$821 million in the quarter—like it’s a holy relic. And yes, cash is king. But that cash is coming from the old, boring, reliable part of the business. The parts that are supposed to drive future growth are the ones that are struggling. It’s like bragging about your pension being solid while your new startup is burning cash. At some point, the old reliable engine can’t pull all the dead weight.

The analyst sentiment is offcourse, still a "Buy" with targets in the mid-$250s. They see the same thing everyone else does: a defensive moat, pricing power, and a business that thrives in good times and bad. They’re not wrong. People will always need their trash collected.

But they’re missing the bigger picture. This wasn't just a bad quarter caused by some external "headwinds." It was a quarter that exposed the fundamental tension inside Waste Management. It's a utility that wants to be a growth company, a monopoly that has to compete in new markets, and an old-school industrial giant trying to sell a new-school ESG story. And right now, the utility part is the only thing that’s working. They want us to believe this is all part of the plan, a temporary hiccup on the road to glory, but...

It's the Same Old Garbage

Look, let's stop pretending Waste Management is something it's not. It's a giant, slow-moving, incredibly stable utility. This earnings report didn't reveal a crisis; it revealed the truth. The market’s shrug wasn't a sign of confidence. It was a sign of profoundly low expectations. The company missed its numbers, fumbled on its big new acquisition, and saw its recycling business get crushed, and nobody cared because nobody expects fireworks in the first place. They expect a dividend check and for the garbage truck to show up on Tuesday. As long as those two things happen, all is forgiven. This company isn't a growth story; it's a bond masquerading as a stock, and this quarter was just a boring reminder of that fact.