Here is the feature article, written from the persona of Julian Vance, as requested.

*

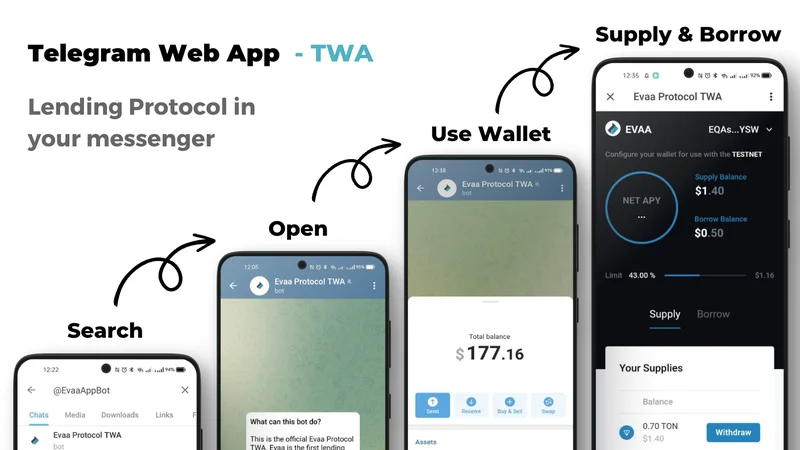

The numbers surrounding EVAA Protocol are, on the surface, impressive. A 211% price surge in a single week. A new all-time high of $10.12 reached while the broader crypto market treads water. It’s the kind of performance that floods social media feeds and commands attention. Behind the ticker, the project pitches a compelling narrative: a decentralized lending protocol built on the burgeoning TON blockchain, seamlessly integrated into the Telegram messenger app.

The story is one of explosive growth and a transition to a user-owned future. The project’s press release from October 27th, 2025, proudly announced the launch of its native token and a Decentralized Autonomous Organization (DAO), effectively handing the keys over to its community. This move coincided with the protocol surpassing $1.4 billion in cumulative transaction volume across 300,000 wallets.

On paper, this is the blueprint for a successful Web3 project. It has venture backing ($2.5 million from names like Animoca Ventures and TON Ventures), a clear product-market fit within a massive ecosystem, and metrics that suggest rapid user adoption. But as with any parabolic asset move, the critical question is whether the price is reflecting a sustainable reality or simply a short-term speculative fever. The data suggests a significant disconnect between the two.

The On-Chain Narrative

Let's first examine the case for EVAA as presented by its own team. The core value proposition is undeniable: bringing DeFi to the massive, captive audience of Telegram. By embedding lending and borrowing functions directly within the messenger as a Mini App, EVAA removes significant friction that plagues many DeFi protocols. There are no complex wallet connections or new interfaces to learn. It’s finance meeting users where they already are.

The reported metrics seem to validate this strategy. Reaching 300,000 wallets since a 2023 hackathon launch is a respectable growth trajectory. The $1.4 billion in transaction volume is a headline figure designed to signal legitimacy and scale. This narrative was clearly compelling enough for a slate of VCs to participate in a recent private sale (a $2.5 million round, to be precise). Their investment, detailed in reports like TON DeFi lender EVAA Protocol raises $2.5 million in private token sale, provides a baseline level of due diligence and institutional confidence that retail traders often look for.

The DAO launch is the capstone of this narrative. By distributing EVAA tokens, which grant holders voting rights on everything from risk parameters to fee structures, the project positions itself as a foundational piece of user-owned infrastructure. CEO Vlad Kamyshov’s vision of creating a “liquidity layer for Telegram” is ambitious and, if successful, could be immensely valuable. This is the story the market is being told, and it’s a good one. It paints a picture of a protocol with strong fundamentals, a clear growth path, and a commitment to decentralization. But the charts are telling a different, more chaotic story.

A Disconnect in the Charts

When an asset’s price action becomes unmoored from its underlying fundamentals, it's essential to analyze the mechanics of the market itself. After its debut in October, the EVAA token languished, settling near $2 for weeks. Then, something shifted. The price broke out, accelerating into a parabolic ascent that defied the sluggish market—a move captured by headlines like EVAA Protocol (EVAA) Price Hits New All-Time High Despite Crypto Market Dump—hitting a high of $7.94 before pushing even further. One data source from October 26th clocked it at over $10—to be more exact, $10.12.

Here is where the data gets interesting. On that day, EVAA’s market capitalization was reported at approximately $68.4 million. Its 24-hour trading volume, however, was $77.6 million. This is a critical discrepancy. When daily volume exceeds the entire market cap of an asset, it signifies an extreme level of churn. The token isn't being bought and held as a long-term governance stake in a promising protocol; it’s being hot-potatoed between short-term traders at a frantic pace. This isn't investing; it's a high-speed game of musical chairs, with participants betting they can sell to the next person at a higher price before the music stops.

I've looked at hundreds of these token launches, and a volume-to-market-cap ratio exceeding 1.0 is a classic indicator of short-term speculative froth, often driven by momentum algorithms and retail FOMO rather than a sober assessment of value. The technical analysis in circulation, referencing Elliott Wave counts and Fibonacci extensions, further supports this. Traders aren't discussing the protocol’s yield generation or risk parameters; they’re charting impulsive waves and projecting price targets of $8.95 or $12.16. This is the language of speculation, not investment.

This raises some uncomfortable but necessary questions about the on-chain narrative. How many of those 300,000 wallets represent genuine, sticky users of the lending protocol versus transient wallets created to farm the token airdrop or engage in speculative trading? What is the composition of that $1.4 billion in transaction volume? Is it a measure of unique capital flowing through the system, or could it be inflated by a smaller pool of capital being rapidly cycled to create the illusion of activity? Without more granular data, it's impossible to know.

The Signal and the Noise

The EVAA Protocol presents a compelling long-term vision. The integration of DeFi into a platform like Telegram is a powerful concept, and the project has secured the backing and partnerships to give it a credible shot at success. That is the signal.

However, the current price action is almost entirely noise. The extreme trading volume relative to its market cap points not to a groundswell of organic adoption, but to a speculative mania. The market is not currently pricing EVAA based on its utility as a governance token or its potential for revenue sharing. It is pricing it based on pure momentum and the hope of offloading it to someone else for a quick profit.

The true test for EVAA will come not in the next week of frenzied trading, but in the months that follow. When the speculative volume subsides, as it inevitably will, what will be left? Will a core community of users remain to govern the protocol and generate sustainable fees? Or will the user count and transaction volume collapse in tandem with the price? The data suggests the risk of the latter is substantial. For now, the hype is loud, but the underlying fundamentals are whispering.