Alright, let's cut the crap.

Every time some crypto token that’s been bleeding out for months gets a 15% bump, the true believers crawl out of the woodwork screaming about a "comeback," asking questions like "Is VIRTUAL Back? VIRTUAL Reclaims $0.80: Best New Crypto?" This week's comeback kid is Virtuals Protocol (VIRTUAL). After tanking for most of 2025, it suddenly found a pulse, and now the narrative machine is kicking into high gear.

But I’ve seen this movie before. A little bit of volume, a couple of green candles, and suddenly we're supposed to forget the brutal 80% haircut from its all-time high. Give me a break.

They're calling this a "sustained recovery." I call it a dead cat bounce until proven otherwise. And the "proof" they're offering is thin, to say the least.

The Hype Machine Gets a Jumpstart

So, what’s fueling this miraculous revival? The holy trinity of modern crypto pumps: a Robinhood listing, some anonymous "whales" buying the dip, and a timely narrative shift.

Let's start with Robinhood. Getting listed on the platform that gamified stock trading for a generation of people who think stonks only go up is now considered a mark of legitimacy. It’s not. It’s a mark of accessibility for retail money to pour in and become exit liquidity. The fact that VIRTUAL immediately dipped 12% on the "sell-the-news" event before this rebound tells you everything you need to know about who was waiting to dump on the new arrivals.

Then we have the whales. Anonymous wallets, tracked on dashboards, are "accumulating." This is presented as a sign of smart money getting in early. It could just as easily be the same team members and early investors who rode it down now trying to engineer a pump to get out at a better price. Who are these people? Why are they buying now? We don't know, and anyone who tells you they do is selling you something.

This whole AI crypto narrative is like a bad Hollywood reboot. The original story—that crypto will change the world—got stale. So they slap a new coat of paint on it, call it "AI," and suddenly everyone's excited again. It’s the same script, just with more buzzwords. VIRTUAL's comeback is perfectly timed with NVIDIA's earnings and a general "rotation" into AI tokens. It feels less like a fundamental shift and more like traders chasing the flavor of the week. Is there any real connection here, or is it just pattern-matching by people staring at charts all day?

Jargon, Unicorns, and Other Fairy Tales

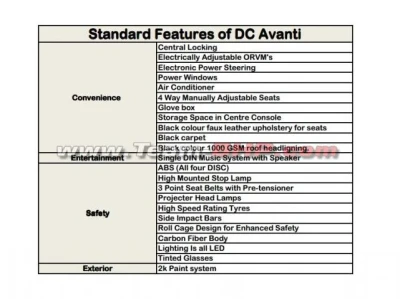

Dig into what Virtuals Protocol actually is—and you can read the full Understanding Virtuals Protocol: A Comprehensive Overview if you enjoy a headache—and you're hit with a firehose of technobabble. "Agent Commerce Protocol." "Agentic Framework." A "conviction-based launch system" called Unicorn. It sounds impressive, offcourse, but what does it actually mean for a user?

The Unicorn system, for instance, gives 5% of future token launches to people staking VIRTUAL. This is a bad idea. No, "bad" doesn't cover it—this is a classic crypto incentive loop designed to create demand for the main token by dangling the prospect of getting in early on the next thing. It’s a mechanism for creating more tokens, more hype cycles, and ultimately, more people left holding bags when the music stops. Will this drive real, sustainable growth, or just a series of speculative micro-bubbles within their ecosystem?

And the core tech, the Agent Commerce Protocol (ACP), is this incredibly dense four-phase system for AI agents to transact onchain. Request, Negotiation, Transaction, Evaluation. It’s a digital bureaucracy for bots. I have to ask: are we just building overly complicated solutions for problems that don't exist yet? The idea of a world run by autonomous AI agents making deals on the blockchain is a sci-fi writer's dream, but in practice...

Then again, maybe I'm the crazy one. Maybe there's a real need for a permissionless, onchain escrow service for AI agents. But right now, it feels like we're building the traffic light system for a city of flying cars that haven't been invented. The tech might be brilliant, but is anyone actually going to use it at scale before the next crypto winter freezes everything over again?

For now, traders are drooling over a "descending wedge pattern" on the chart, a technical signal that supposedly heralds a bullish reversal. The MACD is crossing, the RSI has room to run—it’s all there. But charts don’t create value. They reflect sentiment, and sentiment in this market can turn on a dime. This token is still a ghost of its former self, and it's going to take more than a few technical indicators and a Robinhood listing to convince me this ain't just another ghost story.

Don't Call It a Comeback

Let's be brutally honest. This isn't a comeback; it's a rally. It's a speculative fever dream fueled by retail access and a hot narrative. The project is still down a catastrophic amount from its peak, and the underlying tech, while ambitious, feels more like a solution in search of a problem. Maybe they'll pull it off. Maybe this is the bottom. But betting on that is pure gambling, not investing. I'll believe in the "decentralised agent economy" when my AI assistant can order a pizza without getting stuck in a four-phase negotiation protocol. Until then, this is just noise.