The On-Chain Revolution is Accelerating

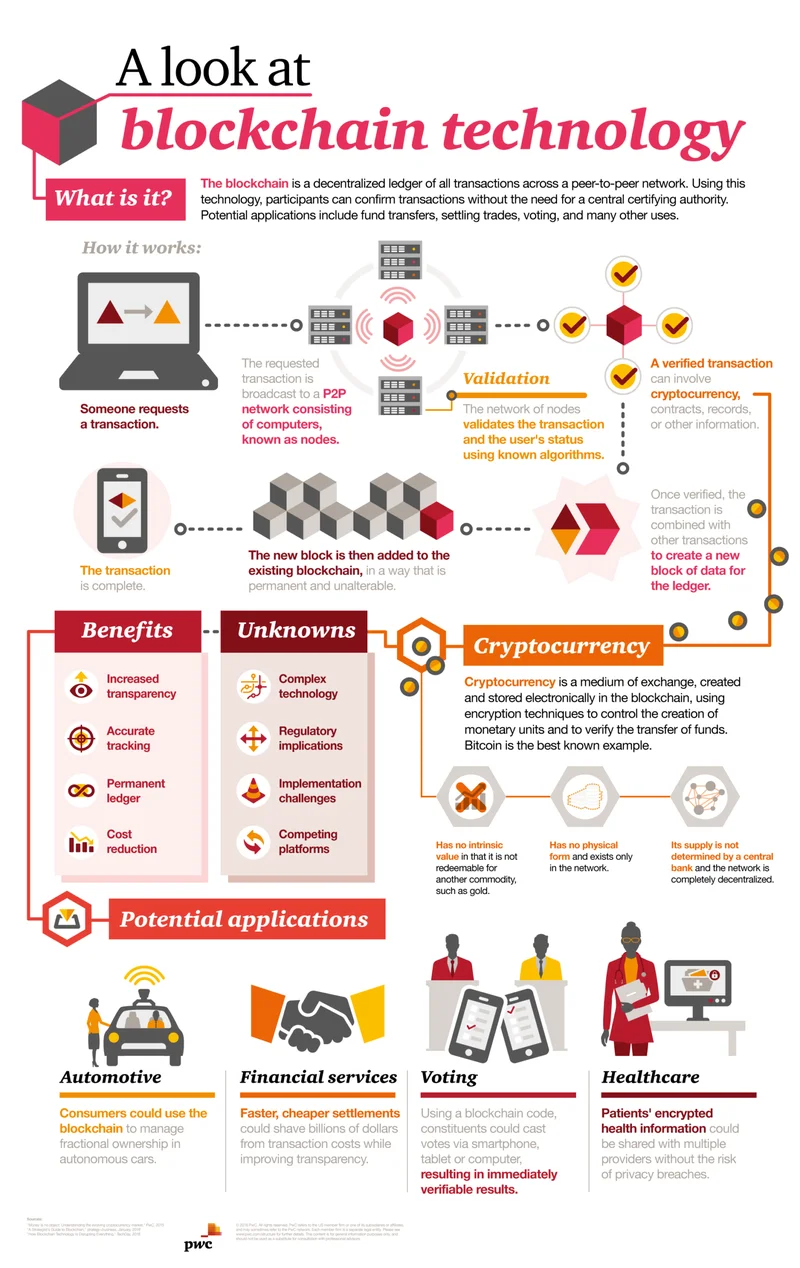

Okay, folks, buckle up, because the future isn't just coming—it's here, and it's being built on the blockchain. We're not talking about just Bitcoin anymore; we're talking about a complete reimagining of finance, powered by transparency, accessibility, and the unstoppable force of decentralized technology. When I first started diving into this world years ago, it felt like a distant dream, but now? Now, we're seeing the pieces fall into place with breathtaking speed.

Think about it: Dinari is teaming up with Chainlink to bring the S&P Digital Markets 50 Index on-chain. That's not just a number; it's a bridge between Wall Street and the digital frontier. Imagine being able to invest in a tokenized version of an index that tracks the biggest players in blockchain, all with the security and transparency of a regulated custodian. It's like the invention of the printing press, but for finance—democratizing access and empowering individuals like never before. This index, expected to launch before the end of 2025, comprises 35 U.S. listed firms connected to blockchain and 15 major digital assets, and Chainlink's providing the real-time data? Absolutely brilliant! (S&P Digital Markets 50 Index Will Gain Blockchain Verifiability Via Chainlink - Decrypt)

And it doesn't stop there. Ripple, Mastercard, Gemini, and WebBank are exploring the use of Ripple's RLUSD stablecoin for settling fiat credit card transactions on the XRP Ledger. Yes, you heard that right. We're talking about potentially bypassing traditional banking rails and settling transactions directly on the blockchain. The implications are staggering—faster settlements, lower fees, and increased efficiency for everyone involved. They're aiming to start onboarding RLUSD in the coming months, pending regulatory approvals, and integrating it into Mastercard and WebBank's settlement processes. What this means for us is a future where cross-border payments are seamless and instantaneous. But more importantly, what could it mean for you, the everyday consumer?

Canada's getting in on the action too, with plans to regulate fiat-backed stablecoins. This isn't a crackdown; it's a sign of maturity. It means governments are finally recognizing the potential of stablecoins and are working to create a framework that fosters innovation while protecting consumers. The legislation will require issuers to maintain adequate asset reserves, establish redemption policies, implement risk management frameworks, and protect sensitive personal information. Sure, regulation can feel like a hurdle, but it's also a validation—a signal that this technology is here to stay.

Even the recent Bitcoin dip below $100,000 isn't cause for alarm. Standard Chartered analyst Geoff Kendrick is recommending traders "buy the dip, in stages," suggesting buying 25% of the maximum investment limit now and another 25% if the Friday close is above $103,000. It's a reminder that volatility is part of the game, but the long-term trend is clear: crypto is here to stay. And, frankly, the folks down at that crypto conference in South Florida weren't sweating it either.

And let's not forget Chainlink's continued integration with traditional finance. FTSE Russell will now use Chainlink to publish its market index data on blockchain networks. This isn't just about data feeds; it's about building a more transparent and trustworthy financial system. Chainlink joined with the U.S. Department of Commerce to integrate macroeconomic data to blockchains. What does this mean? It means that the real world and the blockchain world are becoming increasingly intertwined, creating a more connected and efficient global economy.

Now, I know what some of you might be thinking: "This all sounds great, but what about the risks?" And that's a fair question. We need to be mindful of the potential for misuse and the need for responsible development. But I believe that the benefits far outweigh the risks. Tokenizing equities has been a key theme in 2025, connecting traditional finance and crypto. Backed introduced xStocks, allowing users to trade shares of companies like Tesla and Apple on-chain. Robinhood unveiled tokenized equities for European users in June. Coinbase is considering a similar product.

The Dawn of a New Financial Era

When I first saw the potential of blockchain technology, I knew it would change the world. But even I didn't anticipate how quickly it would all unfold. We're on the cusp of a new financial era, one where access is democratized, transactions are transparent, and innovation knows no bounds. There will be challenges along the way, of course, but I am confident that we can overcome them and build a brighter future for all. The speed of this is just staggering—it means the gap between today and tomorrow is closing faster than we can even comprehend. But the real question is, are we ready for it?